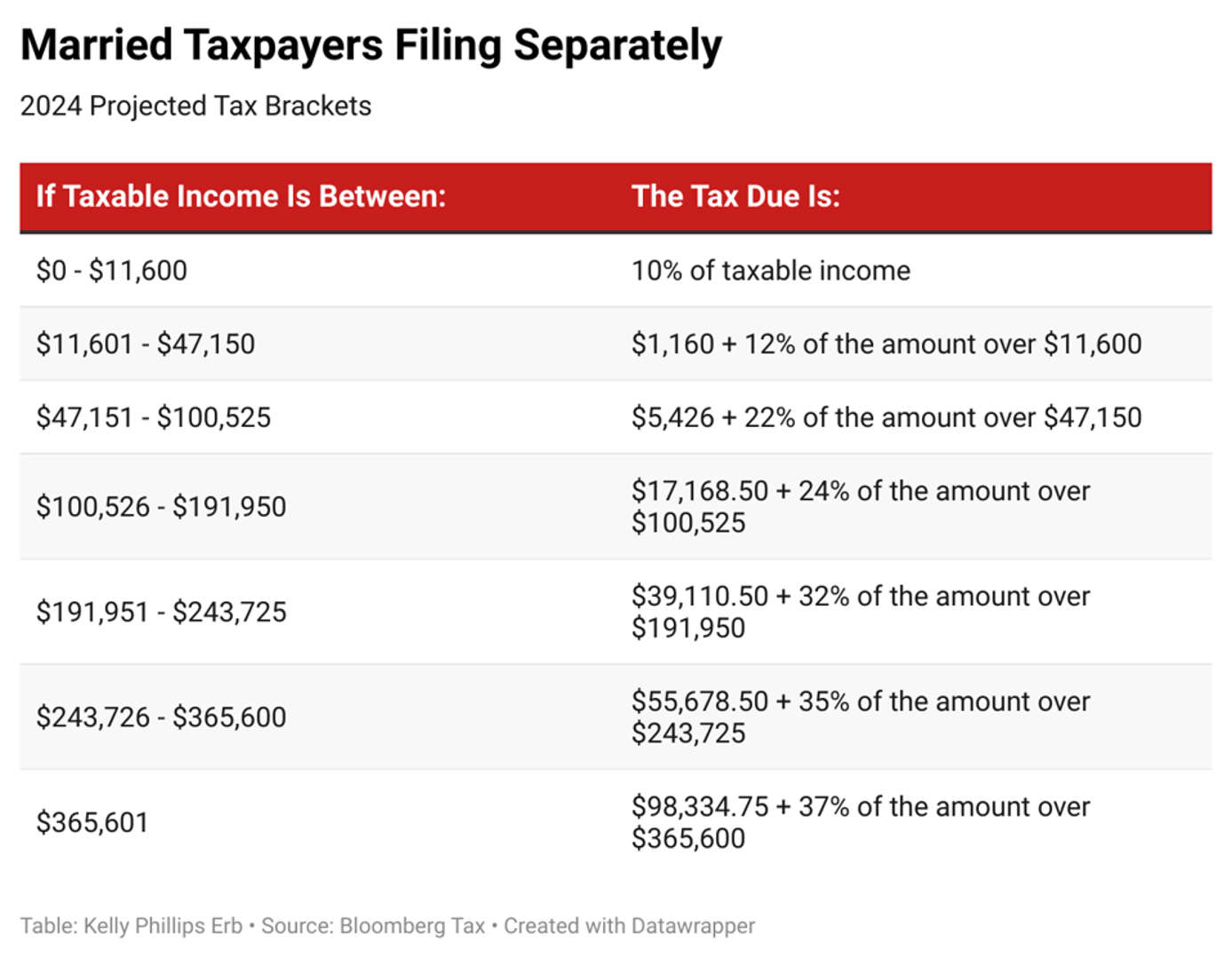

In total, a married couple 65. The difference between standard and itemized deductions, and what they mean.

The standard deduction will increase by $750 for single filers and by $1,500 for joint filers (table 2).

2025 Standard Deduction Over 65 Married Joint Angele Madalena, Tax rates report, giving you an early look at what brackets and other key tax figures will look like in 2025. If you don't itemize deductions, you are entitled to a higher standard deduction if you are age 65 or older at the end of the year.

2025 Standard Deduction Over 65 Tax Brackets Britta Valerie, It's called the extra standard deduction, exclusively for people who are 65 years and. The standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed.

2025 Standard Deduction Over 65 Tax Brackets Elvira Miquela, The standard deduction for those over age 65 in tax year 2025 (filing in 2025) is $15,700 for singles, $29,200 for married filing jointly if only one partner is over 65 (or $30,700 if both are. The standard deduction will increase by $750 for single filers and by $1,500 for joint filers (table 2).

Tax Standard Deduction 2025 Lesya Octavia, For tax year 2025, the additional standard deduction amounts for taxpayers who are 65 and older or blind are: Her total standard deduction amount will be.

2025 Deduction For Over 65 Hedy Ralina, The standard deduction will increase by $750 for single filers and by $1,500 for joint filers (table 2). The tax brackets, standard deduction, and the capital gains tax cutoff point for single and married filing jointly filing statuses will go up in 2025.

2025 Tax Brackets And Deductions Worksheet Bryna Colline, $1,850 for single or head of household. It's called the extra standard deduction, exclusively for people who are 65 years and.

2025 Tax Brackets For Seniors Clovis Jackqueline, For 2025, that extra standard deduction is $1,950 if you are single or file as head of household. In total, a married couple 65.

Standard Deductions for 2025 and 2025 Tax Returns, and Additional, The standard deduction will increase by $750 for single filers and by $1,500 for joint filers (table 2). If you are both elderly.

Your first look at 2025 tax rates, brackets, deductions, more KM&M CPAs, Tax rates report, giving you an early look at what brackets and other key tax figures will look like in 2025. The 2025 standard deduction is $14,600 for single filers, $29,200 for joint filers and $21,900 for heads of household.

2025 Tax Brackets For Seniors Over 65 Timmy Giuditta, The standard deduction will increase by $750 for single filers and by $1,500 for joint filers (table 2). The difference between standard and itemized deductions, and what they mean.

The 2025 tax year introduces significant adjustments to the standard deduction amounts, a critical component of tax planning and strategy.

For tax year 2025, the additional standard deduction amounts for taxpayers who are 65 and older or blind are: